Aims and Objectives

The aim of this module is to let the student know basic business of investment banking,We will try to provides answer what is investment bank?What is the Joint stock company and IPO? How to re-financing at listed companies? Bonds?Merger and acquisition?Asset Secularization?Object Financing and risk management.

Learning Outcomes

By the end of the Module students will be able to:

LO1:explore the basic business transactions of investment bank

LO2:understand the operation of capital market

LO3:grasp the securities issue,corporate mergers and acquisition.asset securitization,and other basic knowledge in the field of segmentation

LO4:use the knowledge in the related cases, analyze and solve problems creatively

LO5:cultivate the ability of scientific investment analysis and decision-making, investment management and regulation. A more intuitive understanding and grasp of the internationalization strategy of investment banks will enable them to have insight into financial problems and analyze financial policies .

Module Outline (brief description of content)

This module is an important course for fintech majors. Prior courses: Western Economics, Commercial Bank Management, etc. It is an important theoretical basis for subsequent professional courses such as Financial Marketing and Fintech, and has a wide range of applications in financial industry, capital market and other fields.

The content of this course is divided into three parts: introduction to investment banking, business of investment banking (PART I) and business of investment banking (Part II). By absorbing the latest research results of investment banking theory, investment banking is systematically and deeply discussed. This program covers the basic concepts and theory of investment banking, and add more focusing on knowledge such as the latest achievements in China investment banking and the interpretation of classic case, make course learners understand and grasp the core content of investment theory and analysis method, cultivating scientific investment analysis and decision-making, investment management and regulation ability, Have a more intuitive understanding and grasp of the investment bank.

Teaching and Learning Methods

Teaching methods and requirements: The theory of this course is mainly lectured, and a large number of cases are added to the teaching. In terms of practical operation, I will join some practical operations in the financial field, such as stock simulation, and use APP to teach students how to operate investment. In the study of students, students should not only complete the basic teaching according to the requirements of teachers, but also read a large number of books and literature according to the reading catalog, and write reading notes.

Learning methods and requirements: Before each class, students should spend about 30 minutes to read the content and the literature and reading list shared by the teacher. After the course, we should search and write down the contents of the subject assigned by the teacher in groups, each time more than half an hour.

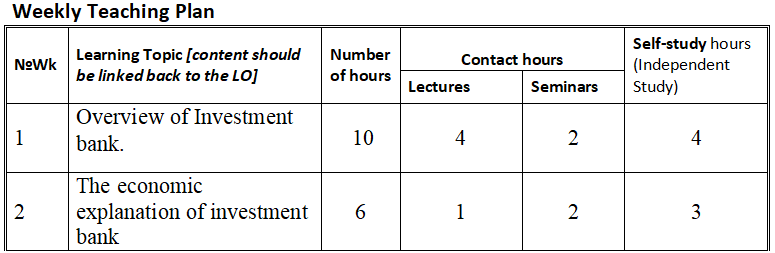

Weekly Programme Content

Week 1. Topic:Over view of Investment Bank

1.What’s the meaning and functions of investment bank

2.Difference between investment bank and commercial bank

3.Understand the main existed forms in difference countries,for example,US.European.UK.Japan.

4.Understand the brief history of investment bank

5.Understand the advantage and disadvantage of investment bank

Week 2. Topic:The economic explanation of investment bank

1.How to promoting the economy basic on investment bank

2.Explain the function of investment bank from the Angle of economics

Assessment

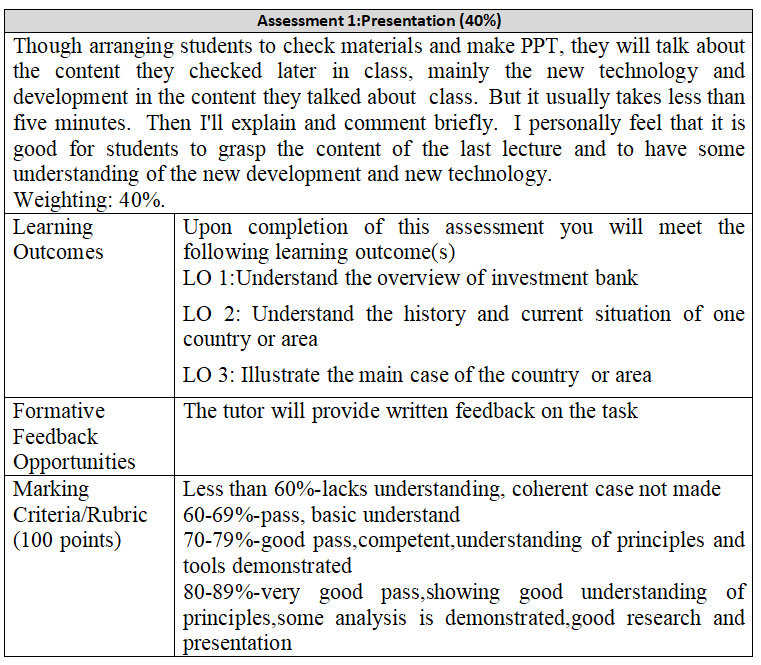

Assessment 1: Presentation for investment banks in various countries (100 point, worth 40% of module mark)

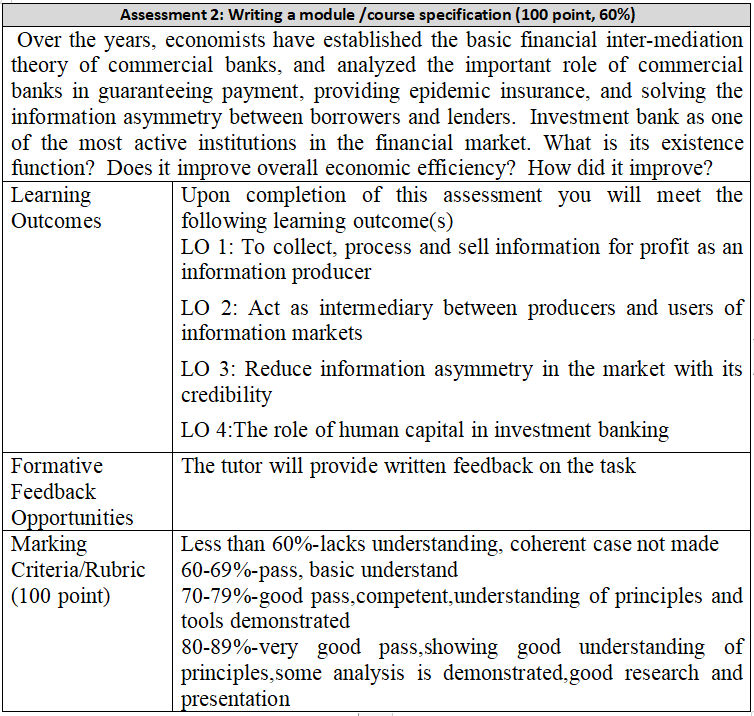

Assessment 2: Write a paper on an economic explanation of the function of investment banking (100 point, worth 60% of module mark)

Reading List

(1) Cheng Kequn, Luan Jingdong, Cao Cailong. Analysis on the Development of Investment Banking business in China [J]. Jianghuai Forum. 2013(03)

(2) Wang Tingting, Tan Chao. Whether China's Investment Banks can take the lead from Behind [J]. Western Collection of Essays. 2008(12)

(3) Wang Wei. American Investment Banks exploring new Development Paths [J]. Economist. 2012(12)

(4)Ritter,JR.Investment Banking and Securities Issuance. Handbook of the Economics of Finance . 2003

(5) Xiong Zhengde, Guo Yanmei. Reputation Mechanism of Securities underwriters: Mechanism, Missing Motivation and Path [J]. Financial Theory and Practice. 2008(03)

(6) Yang Jian. Macro Performance Test of China's Securities Issuance Sponsor System [J]. Journal of Central University of Finance and Economics. 2009(04)

(7) Hong Yanrong. Research on administrative Enforcement Mechanism of SECURITIES and Exchange Commission: "Independence", "Efficiency" and "Responsibility" [J]. Comparative Research. 2009(01)

Related video:

(1) Ma Weihua narrated the history of China Merchants Bank http://www.tudou.com/programs/view/Z4y3sV17fjE/